FinancialPeace: The Money Plan

FinancialPeace is everything you wish you’d learned about money—all in one place. Get the plan that’s helped MILLIONS worry less about money. (Next up? You.)

How do you save more money? Pay off debt? What about investing?

And how the heck do you make a budget and ACTUALLY stick to it? You’ll learn it all—with FinancialPeace.

From Ramsey Solutions, home of The Ramsey Show, FinancialPeace sets you up with a library of online money courses you can watch on the go—including Financial Peace University, the class that’s helped people take control of their money for over 25 years.

All those burning questions you have about money? You’ll get answers. Then, you’ll get our step-by-step money plan—the 7 Baby Steps.

We know money can feel super overwhelming. That’s exactly why we broke it down into simple steps anyone can follow to know they’re doing the right thing with money. Seriously—anyone. (That includes you, btw.)

MONEY LESSONS YOU CAN ACTUALLY UNDERSTAND

Stuffy financial courses? Yeah, we’re not about that. We’re not talking theory. We’re talking practical know-how (in plain English) you can put into practice TODAY to start making faster progress with money.

MONEY EXPERTS YOU CAN ACTUALLY TRUST

Forget your finance professor. Our financial experts teach money like actual humans. (Not a textbook.) Hey, we’ve all made mistakes with money. They have too. And they’ll lay out the principles that will keep you from making those mistakes. Ever. Again.

A MONEY PLAN THAT ACTUALLY WORKS

It’s not magic. It’s not luck. It’s just the simple steps that have worked for millions of people from every walk of life. The Baby Steps are the same for everyone. But the small wins along the way? They’re catered to you. Your life. Your goals. That’s what makes this plan work.

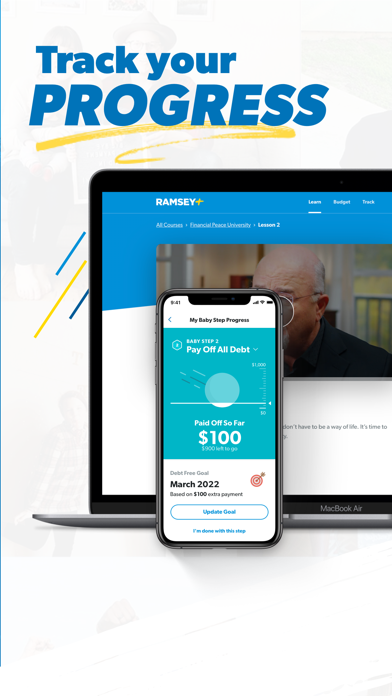

And how will you know the plan is working? Tracking. Your. Progress. With interactive tracking features, you’ll watch your savings grow (along with your confidence). And as your debt disappears, so will your stress level. (Good riddance.)

In fact, in the first 90 days of working our plan, the average household pays off $5,300 in debt and saves $2,700. (Average never sounded so good.)

TRY RAMSEY+ TO GET THE APP

So, first things first. To access this app, you’ll need to be a member of Ramsey+.

Wait, why not just FinancialPeace? Well, here’s the thing—getting better with money takes changing your mindset AND your habits. That’s where Ramsey+ can help. Our apps work together to help you make smarter choices with money. Every. Single. Day. And when those small wins add up, you’ll see BIG results in your bank account—and better money habits that last.

With Ramsey+, you also get access to the premium version of EveryDollar, our easy-to-use budgeting app where you can plan out your spending and saving—so you always know where your money’s going.

Don’t have a Ramsey+ membership yet? No problem. Start your FREE TRIAL.

KEY APP FEATURES:

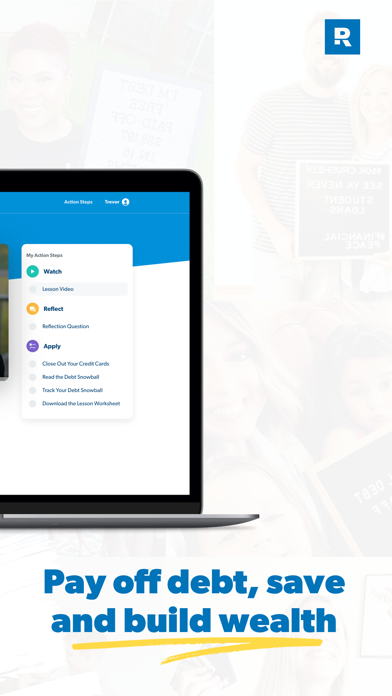

Get Unlimited Streaming of Exclusive Video Courses

* Financial Peace University – Learn how to save money, pay off debt, build wealth and become outrageously generous.

* Jump Start – Start making progress with money right away.

* Budgeting That Actually Works – Get clear-cut guidance on making a budget you’ll actually stick to.

* Know Yourself, Know Your Money – Discover the fears and tendencies with money that have been holding you back.

* And even more!

* Watch on desktop, phone, tablet or Airplay with AppleTV.

Track Your Baby Steps Progress

* Find out which Baby Step you’re on.

* Discover the date you’ll be debt-free using the debt snowball method.

* See your savings, debt payoff and investing progress.

* Track on desktop and mobile.

Note that this app is only available for use in the United States. Please read the Terms of Service: https://policies.ramseysolutions.net/terms-of-use and Privacy Policy: https://policies.ramseysolutions.net/privacy-policy